Navigating the world of health insurance can feel like trying to solve a complex puzzle, especially when you encounter terms like "Critical Illness Insurance vs. Alternatives: A Comparison." You probably have a traditional health plan – the kind that helps with doctor visits and hospital stays. But what happens when life throws a truly severe health curveball your way, like a cancer diagnosis or a major stroke? That's when the financial picture can get surprisingly complicated, and where specialized policies, like critical illness insurance, step in to fill crucial gaps your primary plan might leave wide open.

This isn't about replacing your health insurance; it's about understanding how to build a robust financial safety net so a health crisis doesn't become a financial catastrophe.

At a Glance: What You'll Learn

- Traditional health plans cover medical bills, but often leave you responsible for deductibles, copays, and non-medical costs.

- Critical Illness Insurance pays a lump sum directly to you upon diagnosis of a covered severe illness, offering financial flexibility beyond hospital bills.

- Supplemental health insurance includes critical illness, hospital indemnity, accident, and disability policies, each designed for specific needs.

- Hospital Indemnity Insurance provides cash for hospital stays, helping with unexpected costs or lost income.

- Accident Insurance gives a lump sum for injuries from unexpected mishaps, ideal for active individuals or high-risk jobs.

- Disability Insurance replaces a portion of your income if you can't work due to illness or injury, protecting your livelihood.

- Choosing the right protection involves assessing your health risks, financial situation, and what specific gaps you need to fill.

Beyond Basic Health: Why Traditional Coverage Isn't Always Enough

Let's be clear: a solid traditional health plan is non-negotiable. It's the foundation of your healthcare strategy, designed to cover a wide range of medical services – from routine check-ups and specialist visits to complex surgeries and hospital treatments. You pay your monthly premiums, and when you need care, you share costs through deductibles, copays, and coinsurance. This plan directly reimburses hospitals and doctors for your medical bills.

However, even the most generous traditional health plans have their limits. They're primarily built to cover the medical costs of an illness or injury. But what about everything else?

Imagine facing a serious diagnosis like cancer or a major heart attack. Beyond the medical bills (which your primary insurance will help with, after your deductible), you might suddenly encounter a host of other expenses:

- High deductibles and out-of-pocket maximums that you're responsible for before your primary insurance kicks in fully.

- Experimental treatments not covered by your main plan.

- Lost income if you or a family member needs to take time off work for treatment, recovery, or caregiving.

- Childcare costs if you're unable to care for your kids.

- Travel and lodging for specialized treatment centers far from home.

- Home modifications for recovery (e.g., wheelchair ramps).

- Everyday living expenses like rent, groceries, and utilities, which don't stop just because you're sick.

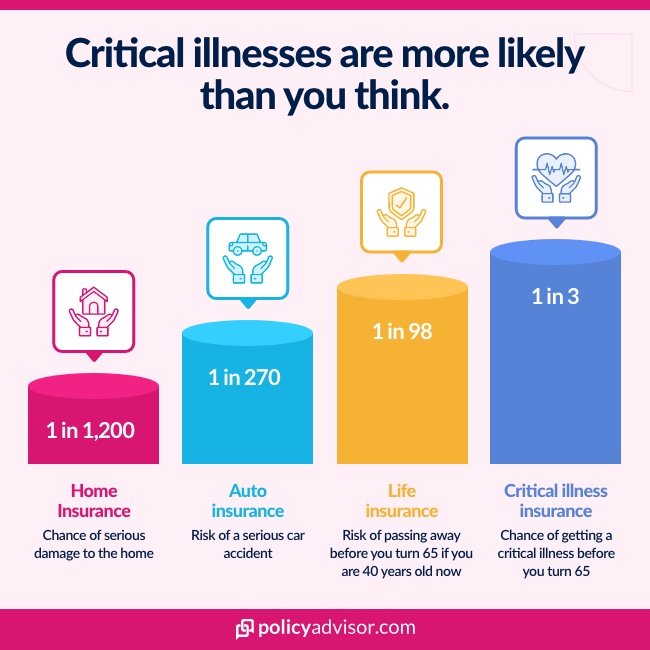

These are the costs that can quickly drain your savings, rack up debt, and add immense stress to an already difficult time. A 2022 survey revealed that over two in five working-age adults are underinsured, meaning their primary health plan leaves them vulnerable to significant financial strain during a major health event. This is where supplemental health insurance, including critical illness insurance, steps in. It's designed to provide financial relief for these non-medical or indirect costs, ensuring you can focus on healing, not on bills.

Critical Illness Insurance: Your Financial Lifeline for Life's Major Curveballs

Think of critical illness insurance as a financial safety net specifically woven for the "what if" scenarios of life-altering health conditions. It's distinct from your traditional health plan because its primary function isn't to pay your hospital bills. Instead, it provides a crucial lump-sum payment directly to you upon diagnosis of a severe illness covered by your policy.

What Kinds of Illnesses Does It Cover?

While specific covered conditions can vary by policy, critical illness insurance typically includes diagnoses such as:

- Cancer

- Stroke

- Heart attack

- Major organ transplants

- Kidney failure

- Multiple sclerosis (MS)

- Parkinson's disease

- Coronary artery bypass surgery

How Does It Work?

The process is straightforward: if you are diagnosed with a covered critical illness and meet the policy's criteria (e.g., a specific stage of cancer), you file a claim. Once approved, the insurance company pays you a pre-determined lump sum of money. This payment is yours to use however you see fit.

The Power of Flexible Funds

This flexibility is a significant benefit. Unlike traditional health insurance, which dictates what specific medical services it will pay for, your critical illness payout can be used for: - Covering your health plan's high deductible or copays.

- Paying for experimental treatments your primary insurance might not cover.

- Replacing lost income for you or a family member taking time off work.

- Hiring home care during recovery.

- Paying for childcare or elder care.

- Making mortgage payments or rent.

- Covering daily living expenses like groceries and utilities.

- Travel expenses to see specialists.

- Simply maintaining your standard of living while you recover.

Who Benefits Most from Critical Illness Insurance?

This type of policy is particularly appealing to: - Individuals with a family history of diseases like cancer, heart disease, or stroke.

- Those with limited emergency savings who couldn't easily cover unexpected out-of-pocket costs or lost income.

- People with high-deductible health plans, as the lump sum can offset these initial expenses.

- Anyone seeking an extra layer of financial security and peace of mind.

Premiums for critical illness insurance are often relatively affordable, and if acquired through an employer, they might even be pre-tax, making it an accessible way to plan for the unexpected.

Exploring the Alternatives: Other Supplemental Protections

While critical illness insurance is a powerful tool, it's just one piece of the supplemental health insurance puzzle. Other types of policies exist, each addressing a different aspect of financial vulnerability during a health event. Understanding these "alternatives" helps you build a truly comprehensive strategy.

Hospital Indemnity Insurance: When You Need More Than Just a Bed

Imagine you're admitted to the hospital for a serious illness, an injury, or even a planned procedure. While your main health insurance covers the bulk of the medical bills, there are still costs. That's where hospital indemnity insurance comes in.

What It Is & How It Works: This policy provides cash benefits – either a lump sum or daily/weekly payments – for each day you spend in the hospital. The payments go directly to you, the policyholder, not the healthcare provider. Some plans may have a short waiting period before benefits begin.

Key Benefits:

- Portability: Your coverage often remains active even if you change jobs or move.

- Flexibility: The cash is yours to use for anything, whether it's covering your primary plan's deductible, coinsurance, medications, or even just daily living expenses while you're unable to work.

- Family Coverage: Many plans allow you to add family members, providing a safety net for everyone.

Who Benefits Most?

Hospital indemnity insurance is valuable for: - Individuals with chronic health conditions that might lead to frequent hospitalizations.

- Those with a family history of serious illness where hospitalization is a strong possibility.

- Anyone anticipating a planned hospitalization, such as pregnancy or scheduled surgeries.

Accident Insurance: Bouncing Back from the Unexpected Mishap

Life's unexpected twists often come in the form of accidents – a broken bone from a fall, a concussion from a sports injury, or burns from a kitchen mishap. While your health insurance will cover the medical treatment, accident insurance helps with the immediate financial aftermath.

What It Is & How It Works: This policy offers a one-time, lump-sum payout if you suffer an injury caused by an accident. The payout amount depends on the type and severity of the injury. Some policies even include coverage for accidental death.

Key Benefits:

- Broad Coverage: Covers a wide range of injuries, including fractures, dislocations, concussions, burns, and more.

- Additional Protection: Many policies also provide benefits for accidental death, blindness, paralysis, or loss of a limb.

- Direct Payment: Like other supplemental policies, the funds go directly to you, for any use.

Who Benefits Most?

Consider accident insurance if you are: - Involved in sports or physically demanding hobbies.

- Working in a high-risk profession.

- A parent looking to cover potential injuries for active children.

- Anyone who wants financial peace of mind in case of an unforeseen accident.

Disability Insurance: Protecting Your Paycheck When You Can't Work

A major illness or injury doesn't just bring medical bills; it can also halt your income. Disability insurance is designed to protect your most valuable asset: your ability to earn a living.

What It Is & How It Works: This insurance covers a portion of your income if you become unable to work due to a serious illness or injury. Policies typically come in two forms:

- Short-term disability: Provides benefits for a few weeks to several months.

- Long-term disability: Kicks in after a waiting period (often 90 days or more) and can provide benefits for years, up to retirement age, depending on the policy.

Both types usually have a waiting period before benefits start, ensuring you're genuinely unable to work.

Key Benefits: - Continued Income: Ensures you can maintain your standard of living, pay bills, and meet financial obligations even when you're sidelined.

- Financial Stability: Prevents a health crisis from completely derailing your financial future.

- Potential Tax-Free Payouts: If you personally fund your policy with after-tax dollars, the benefits you receive are often tax-free.

Who Benefits Most?

Disability insurance is crucial for: - Primary breadwinners whose families rely on their income.

- Anyone whose livelihood depends on their ability to work.

- Individuals with limited sick leave or emergency savings.

- Self-employed individuals who don't have employer-sponsored benefits.

Critical Illness Insurance vs. The Field: A Direct Comparison

It's clear that all these insurance types offer valuable protection, but they do so in different ways and for different scenarios. Let's break down how critical illness insurance stands in relation to both your traditional health plan and its supplemental siblings.

Critical Illness Insurance vs. Traditional Health Insurance: Complementary, Not Substitutes

This is perhaps the most critical distinction to grasp. Traditional health insurance is your shield against the cost of care. It's for doctors, hospitals, prescriptions, and medical procedures. It pays the healthcare providers (or reimburses you after you pay).

Critical illness insurance, on the other hand, is your safety net for the financial impact of being severely ill. It pays a lump sum directly to you upon diagnosis, regardless of your medical bills. This money is for living expenses, lost wages, and any other costs that arise when you're unable to work or when your family is stretched thin.

You absolutely need both. Your traditional health plan ensures you get the medical care you need, while critical illness insurance helps ensure that getting that care (and recovering from it) doesn't bankrupt you or devastate your family's finances. They work in tandem, providing a layered defense against the comprehensive costs of a major health event.

Critical Illness Insurance vs. Other Supplemental Plans: Decoding the Differences

While all supplemental plans aim to fill gaps, their triggers and payouts are distinct.

| Feature | Critical Illness Insurance | Hospital Indemnity Insurance | Accident Insurance | Disability Insurance |

|---|---|---|---|---|

| Trigger Event | Diagnosis of a covered critical illness (e.g., cancer, stroke) | Hospital admission for illness, injury, or procedure | Injury due to an accident (e.g., broken bone, burn) | Inability to work due to illness or injury |

| Payout Type | Lump sum | Lump sum or daily/weekly cash benefits | Lump sum (amount varies by injury) | Portion of lost income (e.g., 60-80%) |

| Payment Recipient | Policyholder directly | Policyholder directly | Policyholder directly | Policyholder directly |

| Use of Funds | Completely flexible: medical gaps, living expenses, lost income, anything | Flexible: deductibles, copays, travel, living expenses | Flexible: deductibles, copays, therapy, living expenses | Covers essential living expenses, mortgage, bills |

| Best For | Those with family history of severe illness, high deductibles, limited savings; anyone wanting financial peace of mind during major health crisis. | Those with chronic conditions, anticipating hospitalization, or high deductibles. | Active individuals, those in high-risk jobs, parents of active children. | Primary breadwinners, anyone whose income is critical to their household. |

| As you can see, critical illness insurance shines when the primary concern is the broad financial fallout of a life-altering diagnosis, especially the non-medical costs and lifestyle disruptions. Hospital indemnity helps with the direct costs and disruptions of a hospital stay. Accident insurance focuses on the immediate impact of unexpected injuries. And disability insurance is singularly focused on replacing your income when you can't work. Each plays a vital, specific role in a complete financial protection plan. |

Making Your Move: How to Choose the Right Protection Strategy

Deciding which type of insurance, or combination of policies, is right for you requires a thoughtful self-assessment. There's no one-size-fits-all answer, but by following a structured approach, you can build a safety net that truly meets your needs.

Step 1: Understand Your Baseline – Your Primary Health Plan

Before considering supplemental coverage, get intimately familiar with your existing traditional health insurance.

- What's your deductible? How much do you have to pay out-of-pocket before your insurance starts covering costs?

- What's your out-of-pocket maximum? This is the most you'll pay in a year for covered services. Could you comfortably cover this amount in a crisis?

- What's your copay and coinsurance structure? These are ongoing costs you'll incur.

- What's your network? Are specialists and hospitals you might need included?

These details will highlight the financial gaps your primary plan might leave.

Step 2: Assess Your Personal Risk Profile

This step is about looking inward and forward.

- Family Medical History: Do critical illnesses like heart disease, cancer, or stroke run in your family? This significantly increases your personal risk and makes critical illness insurance more compelling.

- Lifestyle Factors: Do you smoke? Do you have a sedentary job? Are you overweight? While not definitive, these can influence risk.

- Occupation: Does your job involve physical labor or inherent risks that make accident or disability insurance particularly relevant?

- Existing Conditions: While critical illness insurance typically won't cover pre-existing conditions (more on that below), existing chronic conditions might make hospital indemnity more appealing.

Step 3: Evaluate Your Financial Preparedness

Be honest about your current financial safety net.

- Emergency Fund: How many months of living expenses do you have saved? A strong emergency fund can cover some smaller gaps, but a major critical illness can exhaust it quickly.

- Savings and Investments: How much could you realistically liquidate without jeopardizing your long-term goals if faced with a severe health crisis?

- Income Stability: How dependent are you and your family on your current income? If you're the primary breadwinner, disability insurance becomes extremely important.

Step 4: Consider the 'What Ifs' and Your Priorities

Think about what scenarios worry you the most:

- Is it the thought of major medical bills (even after insurance)?

- Is it the fear of losing your income and being unable to pay your mortgage?

- Is it the concern about non-medical costs like childcare or travel for treatment?

- Are you an active person who worries about an accidental injury?

Your biggest concerns will often point you toward the most relevant supplemental insurance. For example, if cancer runs in your family and you have a high-deductible plan, critical illness insurance could be a top priority. If you work a physically demanding job and have minimal sick leave, disability and accident insurance might be more fitting.

Step 5: Weigh Employer vs. Individual Plans

You can often acquire supplemental insurance through your employer during open enrollment, when starting a new job, or after a qualifying life event (like marriage or childbirth).

- Employer Plans: Often offer group rates, which can be more affordable, and may simplify enrollment. Premiums might be deducted pre-tax. However, coverage can be limited, and it's usually tied to your employment.

- Individual Plans: Offer more customization, allowing you to tailor coverage amounts and specific benefits. They are portable, meaning they stay with you regardless of your job. However, individual rates can be higher, and you'll typically pay with after-tax dollars.

A combination might even be ideal: supplementing an employer-provided disability plan with an individual critical illness policy, for instance.

Common Questions & Crucial Clarity

Even with a good understanding of these policies, some questions inevitably pop up. Let's tackle a few common ones.

"Isn't my regular health insurance enough?"

As we've explored, while your traditional health insurance is essential for medical bills, it typically doesn't cover lost income, childcare, travel expenses for treatment, home modifications, or your everyday living costs. Critical illness insurance and other supplemental policies are designed precisely to fill these significant financial gaps. Having both creates a much stronger financial safety net.

"Can I get critical illness insurance with pre-existing conditions?"

Generally, critical illness insurance, like most health-related insurance, will not cover illnesses that you have already been diagnosed with before purchasing the policy. There might also be a waiting period (e.g., 30-90 days) before certain conditions become eligible for payout, even if diagnosed after the policy begins. It's crucial to read the policy's terms and conditions carefully, especially regarding pre-existing condition clauses and waiting periods.

"What about waiting periods and exclusions?"

Yes, nearly all critical illness and supplemental health policies have:

- Waiting Periods: A specified amount of time (e.g., 30 days, 90 days, or even longer for certain conditions like cancer) that must pass after your policy's effective date before you can claim benefits for a diagnosis.

- Exclusions: Specific conditions or circumstances not covered by the policy (e.g., self-inflicted injuries, illnesses resulting from illegal activities, or certain types of cancer depending on the policy).

Always review these sections in detail before purchasing any policy.

"How much coverage do I really need?"

This depends entirely on your financial situation, lifestyle, and risks. Consider:

- Your annual income: How much would you need to replace if you couldn't work for 6-12 months?

- Your current debt: Mortgages, car payments, student loans.

- Your emergency savings: How much could you realistically use before needing insurance funds?

- Your family's needs: Dependents, childcare, special needs.

- Your primary health plan's deductible and out-of-pocket maximum.

A good rule of thumb for critical illness coverage might be enough to cover your deductible and out-of-pocket maximum, plus 6-12 months of living expenses. For disability, aim for coverage that replaces 60-80% of your income.

"Is critical illness insurance worth it?"

Many people wrestle with this question, trying to weigh the cost against the potential benefit. The "worth" often comes down to your personal risk tolerance, financial situation, and peace of mind. For those with family histories of severe illness, high deductibles, limited emergency savings, or simply a desire to reduce financial stress during a health crisis, critical illness insurance can be incredibly valuable. It's an investment in your financial stability and your ability to focus on recovery. If you're still weighing the pros and cons, dive deeper into the specifics of why critical illness insurance could be worth it for your unique situation.

Your Next Step: Building a Robust Safety Net

Understanding the differences between critical illness insurance and its alternatives is the first crucial step toward building a truly robust financial safety net. You've seen that your traditional health plan, while vital, has limitations, and that supplemental policies like critical illness, hospital indemnity, accident, and disability insurance each play a unique role in safeguarding your financial well-being during a health crisis.

Don't wait until you're facing a diagnosis or an injury to realize you have gaps in your coverage. Take action now:

- Review your current insurance portfolio. Pull out your primary health insurance documents, any existing supplemental policies, and your employer benefits package.

- Honestly assess your risks and financial vulnerabilities. Use the decision-making framework we discussed.

- Talk to a qualified financial advisor or insurance professional. They can help you navigate the complexities, understand specific policy details, and tailor a plan that fits your budget and needs.

In a world where health challenges are unpredictable, being financially prepared provides an invaluable layer of security. By thoughtfully combining the right policies, you can ensure that when life throws a curveball, you and your family are ready to catch it, recover, and move forward without devastating financial strain.